Your budget is the fuel of your PPC campaign, so it benefits you to make it pay off in returns. Most businesses have budget constraints that keep them from spending more money and hoping for the best. Instead, you have to make your case to allocate more dollars toward something worth testing.

You should always make your case with data. But if you have a tough sell because you've already allocated your budget, changing the way you present the data could help you bolster your plan.

The customer acquisition cost (CAC) formula calculates how much money you spend on acquiring a customer through your marketing efforts. It's a usually straightforward formula that helps guide campaign decisions. You can use your CAC to identify the most profitable marketing channels and correctly allocate your ad budget.

But what if it's not so straightforward? Customer acquisition cost metrics can cover more factors to offer a wider representation of what's happening in your marketing channels.

This article will consider three ways to calculate your CAC and how CAC can help you create a better PPC strategy. First, let’s discuss the traditional customer acquisition cost formula.

Customer acquisition cost formula

A business’s customer acquisition cost is the money it spends on acquiring new customers. These expenses can include:

- Salaries

- Tools/software

- Travel expenses

- Logistics expenses

- Ad spend

- Agencies/freelancers

There's a good chance these costs will fluctuate from month to month. You might add new employees, new tools, or new freelancers. You might also have expenses that don't appear in other months — such as an annual subscription fee for a tool. That's why it's important to calculate these expenses monthly. Your customer acquisition costs will change based on these numbers.

You can calculate customer acquisition cost in three ways.

Basic customer acquisition cost formula

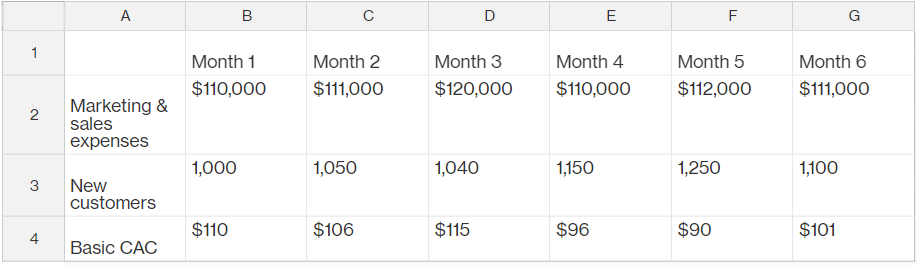

Some businesses calculate CAC like this: total sales and marketing spend over a specific period divided by the number of new customers over that same period. The basic CAC formula is what you need when you have a short sales cycle (< 30 days). For companies with a longer sales cycle (≥ 30 days), calculating CAC with this formula is inaccurate.

For example, let's say your sales cycle is two months on average. One month, you decide to increase your advertising budget by $10,000. Though your expenses increased by $10,000 for that month, you won't see a return on that investment until after two months. If you calculate your CAC based on the current month's expenses, it's going to look much worse than it is.

In the table above, Month 3 contains the $10,000 advertising increase, and Months 4 and 5 contain the increase in new customers that resulted from the advertising increase. Your CAC is based on Month 3's expenses since your sales cycle is two months long. The CAC is $115, which is higher than average. It's high enough that you might call your advertising campaign a failure.

However, if you use a different formula, you’ll get different insights and avoid hasty and inaccurate conclusions.

Time-based customer acquisition cost formula

When you have a longer sales cycle, calculating your CAC using the basic formula will give you inaccurate results. The time-based CAC formula helps you calculate your CAC accurately if you have a longer sales cycle, say two months or more.

Here, you’re calculating your CAC based on your expenses from two months ago. The equation is: marketing and sales expenses from two months ago divided by the number of new paying customers in the current month.

With this formula, you might not notice a difference for most months. But when you have months with increased expenses, it will normalize your CAC and give you an accurate number to determine your marketing performance.

This time-based CAC equation has decreased our CAC for Month 3. In the basic CAC equation, Month 3’s CAC was $115. In this time-based model, Month 3’s CAC is $106, which is about average based on the CACs of previous months.

The correct CAC number for Month 3’s extra investment appears in Month 5 because of the two-month sales cycle. CAC for Month 5 has increased, but at $96, it's still well below average. You can, therefore, call this campaign a success.

Marketing channel-based customer acquisition cost formula

Calculating CAC by marketing channel means measuring the impact of your customer acquisition efforts independently of each other on various marketing channels. Let’s say you’re using paid ads, SEO, and email as marketing channels. Instead of combining your expenses and customers acquired on these channels, you’ll calculate these independently. Use the basic CAC formula for your CAC calculation by channel.

PPC ads: total PPC investment over a particular period divided by the number of customers attributed to the PPC ads in that same period.

For PPC ads, you can further simplify it by calculating your customer acquisition cost per PPC ad network. Your CAC formula will be your total investment in the PPC network over a certain period divided by the number of customers attributed to the PPC network.

- SEO: total SEO investment over a certain period divided by the number of customers attributed to organic search.

This method of calculating CAC helps you to identify unprofitable marketing channels and profitable channels where you’re either wasting money or can improve.

Let’s use a fictional SaaS company called Fries Analytics as an example. Fries Analytics makes accounting analytics tools for restaurants. They've invested in SEO in the past year to get more customers through search engines. These are their expenses.

- SEO team: $6,250

- Sales team: $26,400

It gets a bit complex. For CAC by a source to work, you need to calculate the amount of time your sales team spends on leads from that source only. For Fries Analytics, their salespeople report that organic leads require much less work. As a result, Fries salespeople only spend 33% of their time working on organic leads.

Month 1's CAC isn't available because of the one-month sales cycle, but Fries organic CAC drops steadily month over month in the first six months. Let’s see what it looks like by the end of the year.

The CAC keeps dropping, and by Month 12, Fries CAC is down to $288. Continue your investment when you notice that your CAC is getting lower each month. For some channels like SEO, you’ll experience compounding results the longer you invest in them. So stay the course, and see how low that CAC can get.

How understanding CAC can improve your PPC strategy

Once you determine the most accurate way to calculate your CAC, it’s helpful to look at how that number can influence your decision-making during your advertising campaigns. Get the relationship between your CAC and other aspects of your advertising campaign right, and you’ll realize higher ROI, increased savings, and better insights into creating an excellent PPC strategy.

Here are three ways your CAC can help you improve your PPC strategy:

It helps you bid on more profitable keywords

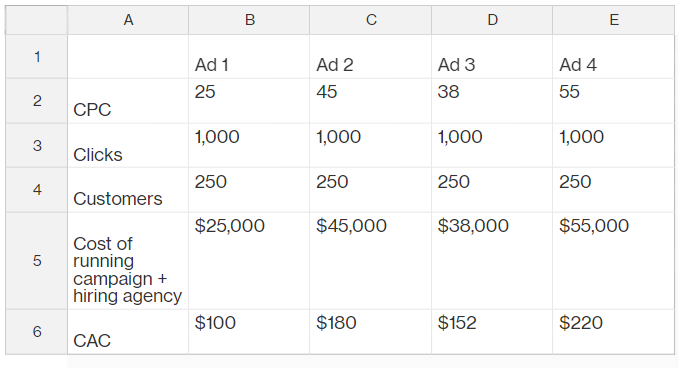

Look beyond keywords and cost per click (CPC) when you run your PPC campaign. Imagine you’re running four PPC ads simultaneously for different keywords. At first glance, you’re getting the same ROI from these four ads: every thousand clicks give you 250 new customers. Some marketers would allow all four ads to continue running simultaneously.

From the table, you can easily see that Ad 1 provides the best return on investment, followed by Ad 3. You’ll get a better ROI if you invest more in Ad 1 and less in Ad 3. In this case, you would stop Ads 2 and 4, as the costs are too high for the ROI.

Again, there’s a caveat here, depending on your product and the audience you’re targeting: you may need to look beyond your immediate expenses and immediate ROI. Your ROI right now may not be a great indicator of the viability of your investment in the long term, especially if it worsens your payback period.

It helps you optimize your PPC campaigns for better payback periods

The CAC payback period is the amount of time it takes to recover your customer acquisition costs. To calculate the payback period, divide the amount you’re investing by the amount you’ll earn from your investment.

If you spend $50,000 monthly on PPC ads and get 250 customers worth $8,000 in total monthly revenue for your business, it would take just over six months to recover your initial investment. Overall, shorter payback periods are more attractive than longer ones.

In ideal circumstances, the higher your CAC, the longer the payback period for your PPC investment. Let’s consider the example we used earlier, including payback periods this time. The company is selling SaaS subscriptions for $22 per month. The expected revenue from 250 customers is $5,500 monthly.

From this calculation, Ad 1 still wins. But let’s say that Ad 4, the worst-performing ad, targets a different demographic, one where the average revenue per customer is higher. Let’s also assume this demographic is buying an enterprise plan that costs $200 monthly per customer. Here’s the current table:

You can see that Ad 4 smashes Ad 1 and provides the best payback period. The sooner you’re able to recover your investment, the faster you can re-invest in your business. Re-investment allows you to perform experiments and optimize your PPC campaigns for the highest ROI, even when the CAC may be higher. And without financial investments, it’s impossible to calculate CAC.

It helps you to calculate and improve customer lifetime value (CLV)

Customer Lifetime Value (CLV) is a customer’s total contribution to your company’s revenue over the lifetime of their relationship with you. Calculate CLV using the formula: (annual revenue from customer x customer lifetime) - CAC. Ideally, a lower CAC increases your customer's lifetime value because you'll make more profit if a customer costs less to acquire.

When comparing your CAC to your CLV, the latter should always be the higher number. But how high is good enough? According to Geckoboard, “4:1 or higher indicates a great business model. If your ratio is 5:1 or higher, you could be growing faster and are likely under-investing in marketing.”

A CLV to CAC ratio higher than 5 requires more investment in PPC ads and other forms of marketing because it signifies there’s room for more customer acquisition without hurting your CAC. You’re likely missing out on potential customers who might not have as high a lifetime value as your current customers but can still deliver an exceptional ROI.

Whenever possible, calculate your CLV based on your customer demographics. For example, Fries Analytics may run different PPC ads targeting solopreneurs, small businesses, medium-sized businesses, and large enterprise companies. Again, let’s call these Ads 1, 2, 3, and 4.

For many SaaS businesses, solopreneurs pay the lowest subscription fees, while large-scale enterprises pay the highest fees. The customer lifetime is constant across these demographics, and the monthly pricing is as shown below:

- Solopreneurs: Ad 1 — $29

- Small businesses: Ad 2 — $49

- Medium-sized businesses: Ad 3 — $79

- Large enterprises: Ad 4 — $149

For Fries Analytics, large enterprises have the highest CLV to CAC ratio, which means that despite their high cost of acquisition, they’re the most profitable customers. In simpler terms, it implies that for every dollar Fries Analytics spends on ads for large-scale enterprises, they get $11 back. That’s an exceptional ratio and further proof that when money isn’t a problem, expensive CPCs and CACs shouldn't deter you.

Calculate your CAC, and run successful PPC campaigns

You can achieve a higher return on your PPC investment by calculating your CAC. Your CAC will help you get buy-in from the decision-makers in your organization for allocating your PPC ad dollars the best way possible.

With every PPC campaign, you’ll discover your best customers and the messaging that attracts them to your product or service. Incorporate those insights into your PPC campaigns and directly target prospects' preferences and needs. You’ll make data-driven decisions that will increase your company’s bottom line.