Competitive research is the foundation of any strong marketing strategy. It’s important to identify your competitors and their marketing tactics to help you differentiate your offering.

There’s reason to dive deep into your competitive research. When you’re taking on a new client or project, you research the competition. Be sure that you’re thorough: if you stop short, it can do more harm than good.

We can all easily rattle off the names of biggest competitors, but what about those that don’t make the “top of mind” list?

By ignoring them, you’ll get a false sense of security that opens you to trouble. You could develop the wrong strategy or leave a big portion of keywords untapped. Guarding fully against every threat means knowing the full scope of your competition.

What You Will Learn

You will learn how to spot your emerging competitors in addition to confirming where your bigger competition stands.

In Part 1, you will get a snapshot of the full competitive landscape–including domains you might have overlooked.

Later in Part 2, we’ll cover the Giants of a Niche as well as finding domains that rank for Valuable Keywords — and how those aren’t always the ones ranking for the most keywords.

Part 1: Start with a competition analysis

1. How to find your online competitors

Finding your competitors doesn’t have to be a time-consuming process. The first step is to identify the keywords that your site ranking and running ads for. If you don’t have a list of seed keywords, don’t panic.

There are a number of tools that you can use to create your list of keywords, including Google’s Keyword Planner, and SpyFu. You can read our keyword research guide if you need any help with finding the organic and paid keywords for your website.

Once you’ve built out your keyword list it’s time to move on to finding your competitors.

Searching your keywords on Google

This is the easiest way (and the most manual) for finding your online competitors. A simple Google search of your keyword will display other companies that are ranking on your seed keywords. For example, if you sell smart mattresses, and you search for this term you will instantly be able to see who’s ranking on the SERP (search engine results page)

Keep in mind that your search results can vary based personalization and your location. You can disable Google Personalization via the browser by adding pws=0 to the URL path.

It’s also important to pay close attention to the paid results that are listed on the SERP. These companies are bidding to appear on the SERP for this particular keyword and often times will be direct competitors of your company.

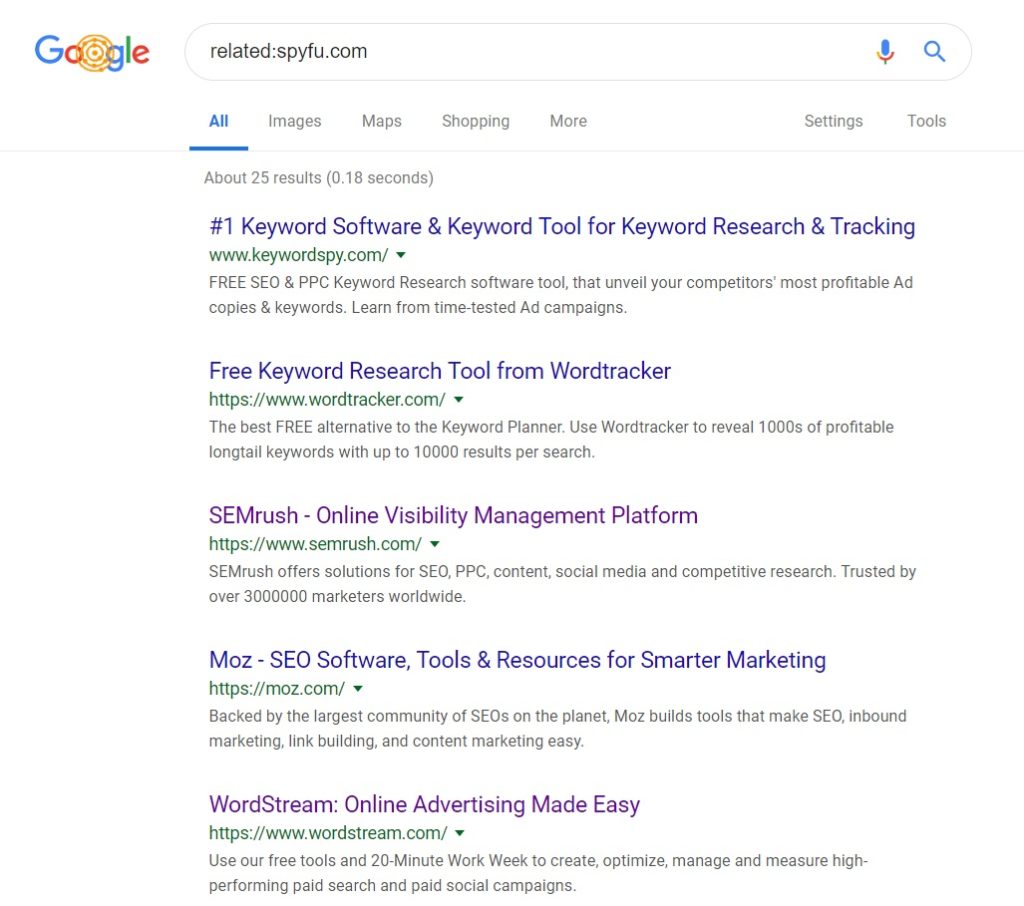

Using Google Search Operators

This method is less time-consuming compared to searching your keywords one-by-one using Google search. Google Search operators let you drill into the results on Google, and narrow your search to find exactly what you need. We wrote a detailed guide on all of the Google Search Operators and how to use them.

For example, “Related:” is an operator that helps you find sites related to a specified URL. Using it is an objective look into how Google categorizes your website and your competitors.

We learn that Google understands the categorical hierarchy of SEO inside of online marketing.

2. Using SpyFu to uncover hidden competitors

When you want to focus on one or two major competitors, that calls for a deep dive. We recommend this tutorial to research your competitor’s strategy.

However, you can't create a full competitive strategy without addressing the competitors that don't hit top of mind. This competition analysis focuses on identifying who those competitors are. Finding them--and updating your strategy accordingly--helps you from being caught off guard by rising businesses creeping into your space.

Let’s start with a search in SpyFu.com.

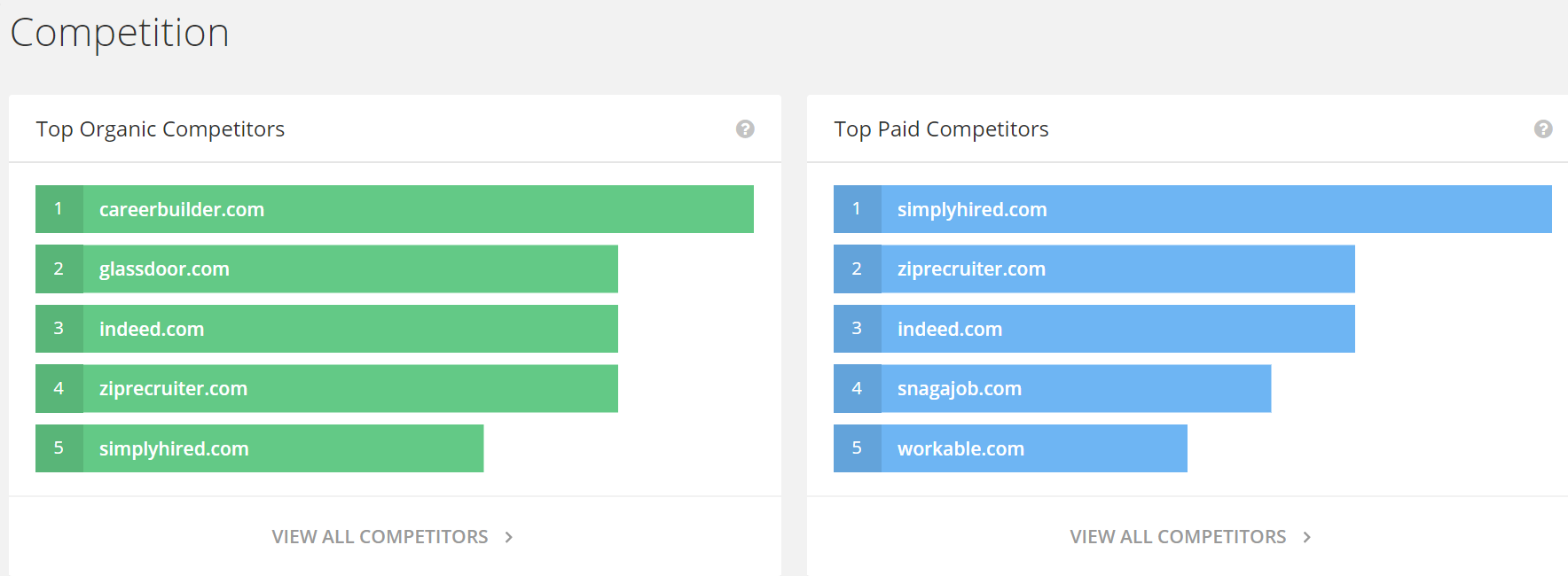

I started by typing Monster.com into the search bar and scrolling down to the Competition section.

This section shows the site’s top organic competitors on the left and paid competitors on the right. Since we’re on the overview page, this is just a preview. Click “View All” for an interactive chart.

The chart loads with the domain’s top current competitors.

You can always change the competitors on the chart to compare against specific domains. But since you’re in discovery mode, let’s stick with the top competitors.

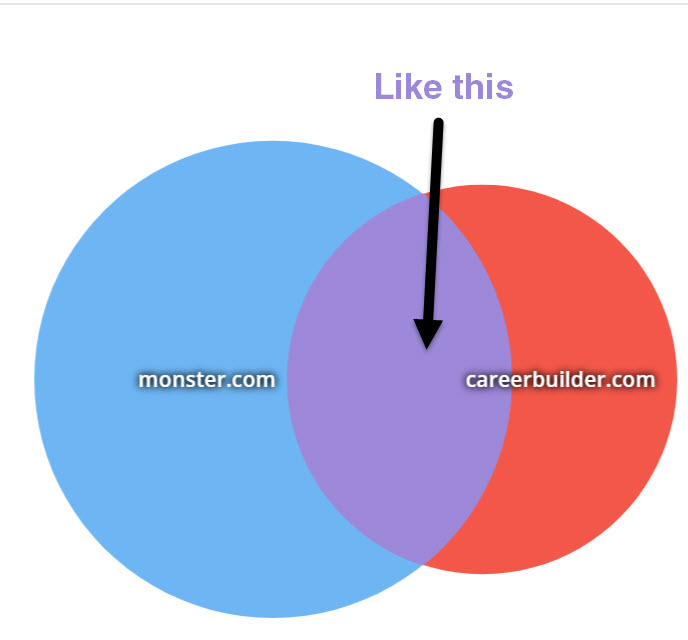

By the way, these are the domains that, when compared to the original domain you entered, heavily overlap each others’ ranked keywords.

The first five domains on the list keep you focused on that website’s most relevant, most pressing competitors. You can still add other domains the chart by choosing them below.

3. Stay on top of changes in the market

Let’s stick with the job hunt niche. As the job market shifts, specialty or focused competitors shift too.

In the mid-2000s, TheLadders.com focused on jobs in the $100,000 + annual salary range. Ten years later, it offered alerts on jobs over $40,000 a year. That shift affects its rankings as well as the specific keywords it ranks for. It’s important to stay on top of evolving competition, especially the sites that are edging into the top ranks and snagging a bigger share of traffic.

For any other job site that targeted entry-level jobs, TheLadders.com would have never been on their radar. They didn’t share a target. One market shift later, and they’re direct competitors.

4. Watch for emerging competitors

If I searched “post a job” on Google right now, we’d see sites in the SERP like Indeed.com, Monster.com, and Glassdoor.com in top results. However, that’s just a single blink of what’s happening today. What about last month? Six months ago?

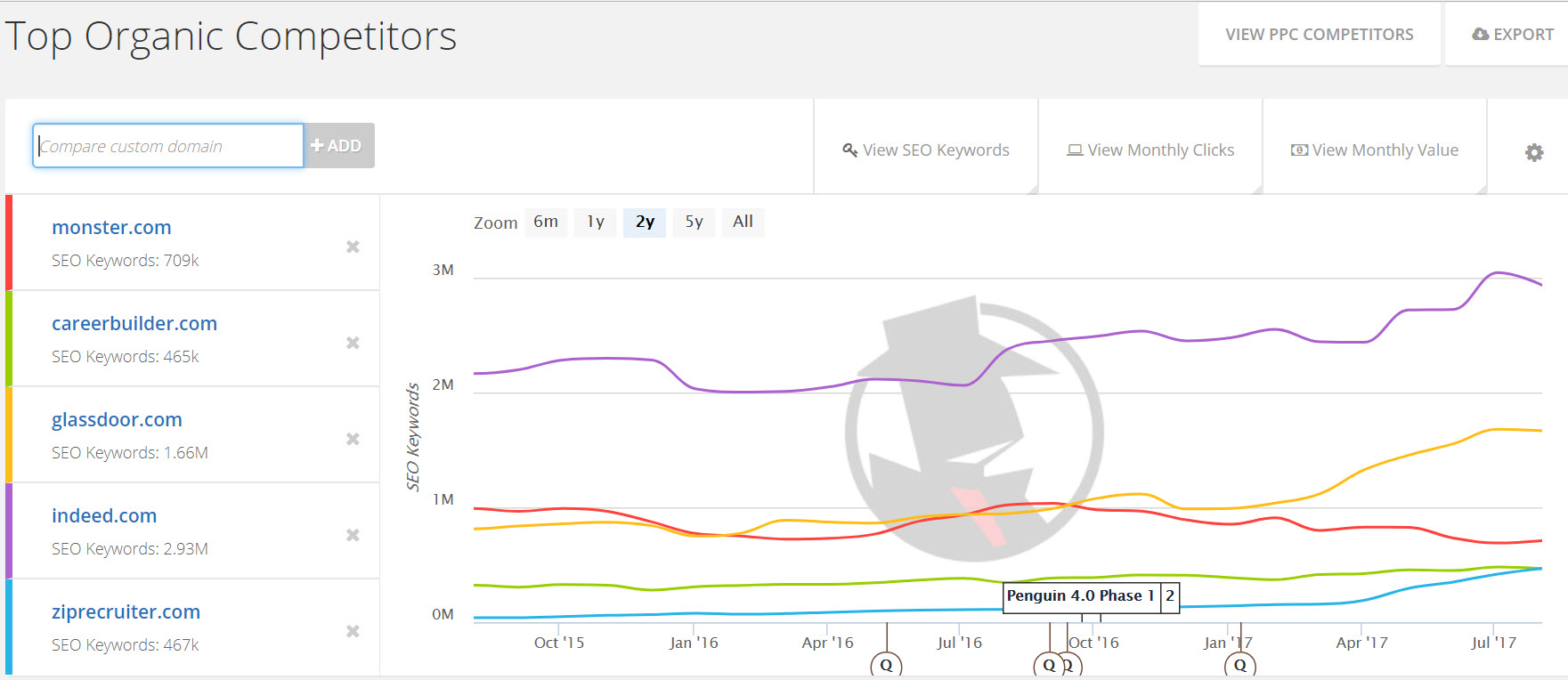

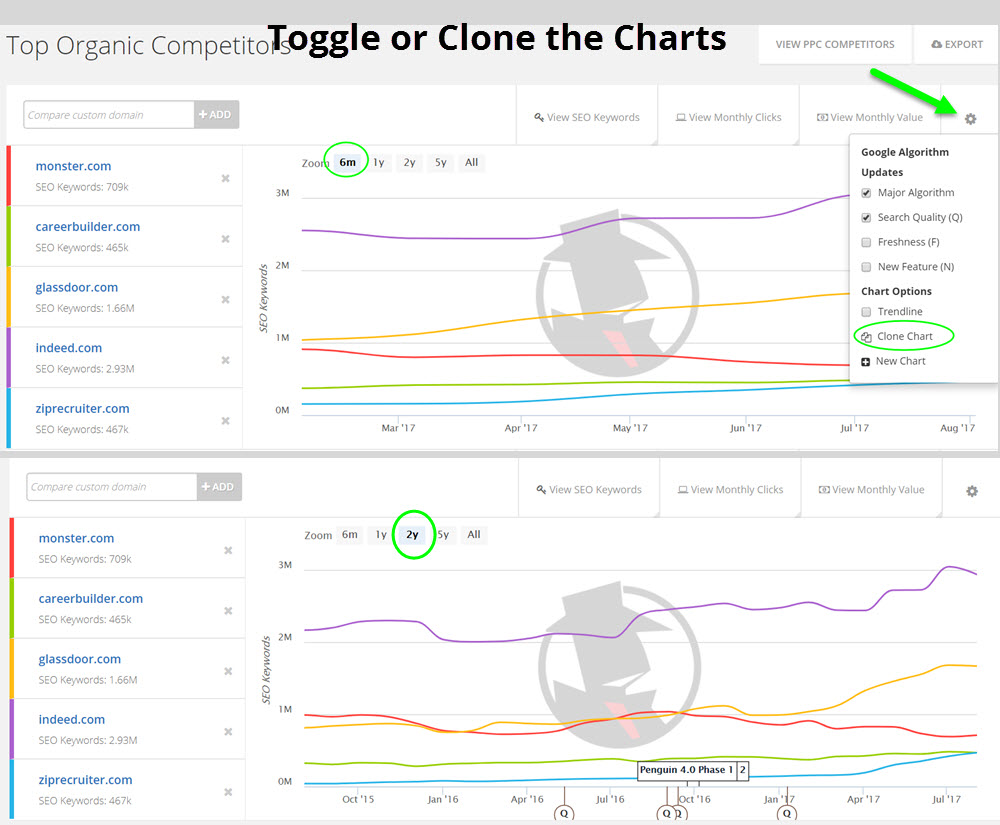

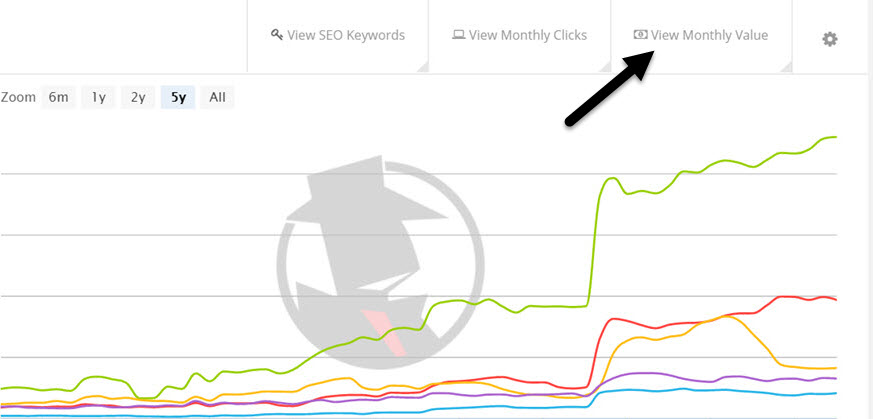

This chart includes a time scale that changes the view from the most recent 6 months to 5 years (and beyond). I suggest this feature to help you catch changes that happen over time.

Instead, I search a domain (Monster.com) to find its top competitors now and over time. Simply toggle between the dates to change the time span. You’ll see how many keywords those same sites ranked for — and how those numbers changed — over time.

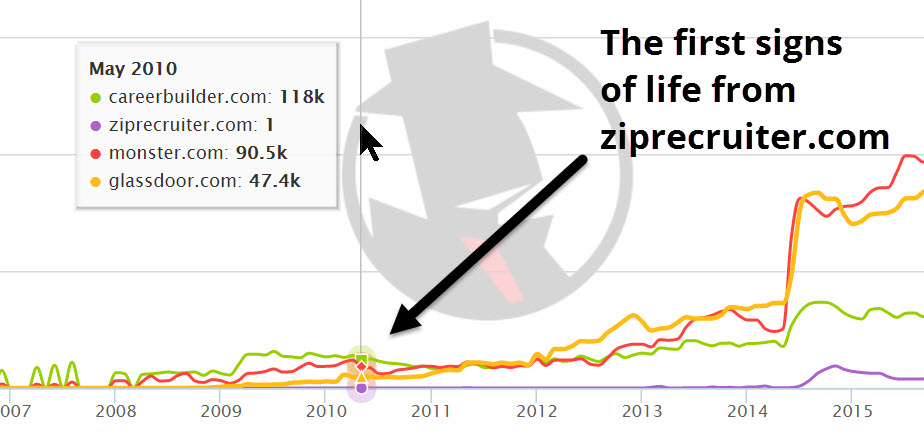

Looking back at ranking patterns over 6 months tells me that Ziprecruiter.com (bold purple line) has been a consistently growing competitor and not just a blip. Going back even further, I can see where they initially popped up from the mix.

I wanted to make sure that I wasn’t completely missing something with Zip Recruiter. If they had been a strong competitor but just recently had a lapse, I would have been chasing the wrong domain. I didn’t want to botch things by referring to an old powerhouse as a fairly new kid to reckon with. I wanted to know exactly when Zip Recruiter jumped on the scene. Easy enough:

A quick check of Ranking History for Ziprecruiter.com (under the SEO Research tab) tells me that the company started ranking on a few branded and basic keywords way back in 2010.

Not new at all.

However, its big leap ahead on more keywords with more traffic hit as recently as late 2016 and into 2017. OK, this hunch stands.

5. Find more up and coming competitors

That exercise helped me confirm a fairly new top competitor, but what about still-growing, emerging sites?

They’re actually listed. Just scroll below the chart for a list of relevant sites that also share a good portion of keywords. You can click them to add them to the chart.

Part 1 Takeaways

Checking in on current competitors helps you stay on top of changes that are happening now, but looking back at patterns helps you see them surge. Patterns over time give you a better sense of a site’s staying power vs. what you see in a few SERPs over the past few weeks.

What’s Next in Part 2

- Understand who dominates a niche (and have they toppled another king)

- Find which domain has the most valuable keywords.

Part 2: Identify Hidden Lessons

Knowing your competition helps you create a well-rounded marketing strategy. It’s crucial that you know every threat — no matter how strongly they stand out in your mind.

Sometimes a competitor isn’t the biggest; they’re just the most memorable. Make sure that you watch out for less-recognized names who could be pushing harder for a share of your audience.

That’s why in the following pointers, we’ll help you learn from insights that would have been hidden away with the usual first glance at the competition.

6. A new approach when you research competitors

Going forward, you’ll be finding the giants when you enter a new niche AND ALSO finding domains that get more out of their ranks. They might not rank for the most keywords, but they are ranking often for the most valuable keywords.

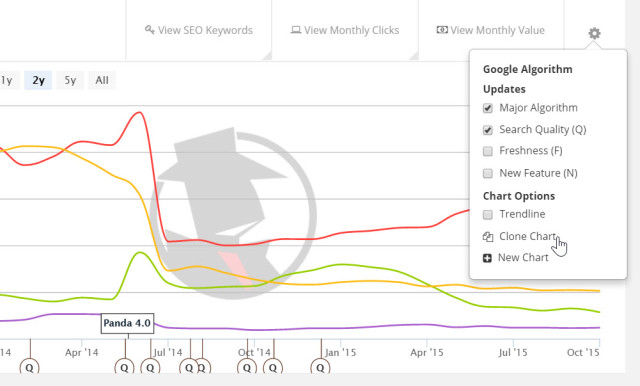

Watch for the chart cloning I’m going to show you later in this post, too. It helps you compare changes from one-time span to another or compare metrics like clicks vs. number of keywords.

7. Understand who really dominates the niche

This is your giant-finder. It might seem simple on its own. Many industries have brands that boast major recognition. However, that’s often limited to major industries and, as we learned in part one,** you want to be cautious since “top of mind” competitors don’t always equal “the strongest competitors.”** Case in point right here.

Monster.com has been a job listing giant for years. They’ve been advertising during the Super Bowl for at least 15 years, so they have been the name to chase in this niche.

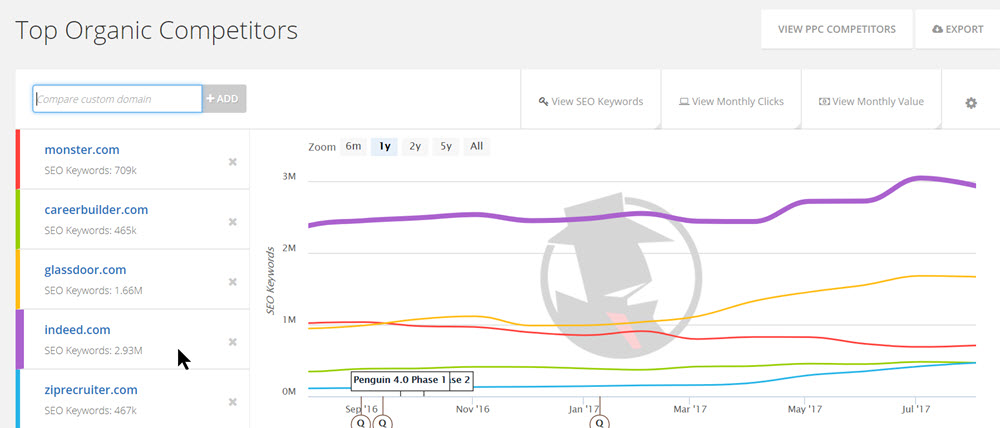

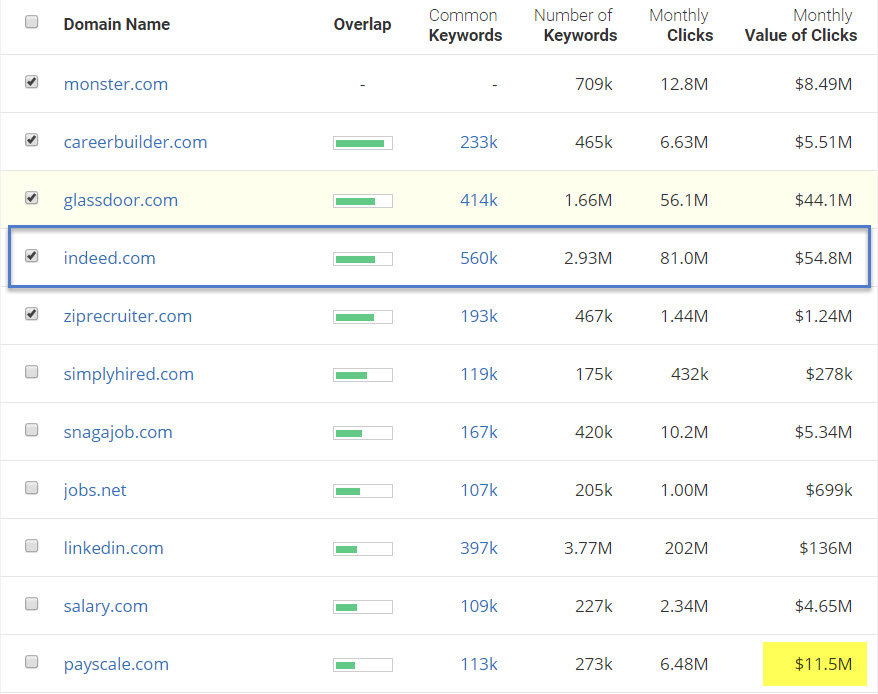

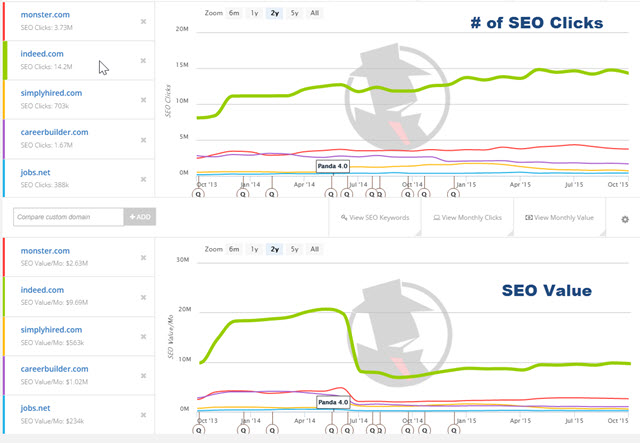

However, when it comes to the site that ranks on top keywords in the job hunt niche, Indeed.com turned into a (surprising) dominator. All it takes is searching one industry-related domain (strong or not) to open a chart like this. You’ll learn if the niche you’re researching has a powerhouse site (and who that site is).

Indeed.com has jumped ahead during the past 12 months, but I can also adjust the time setting (zoom) to look at a tighter window or the longer, bigger picture.

I would have guessed that Monster.com dominated for a long time, and Indeed.com just started emerging over the past year. You can mark that assumption as “completely wrong.”

What really happened

About 8-10 years ago, Careerbuilder.com loomed over everyone, getting more SEO clicks only to fizzle its reign (at least with online presence) before Indeed.com came out ahead more than 4 years ago. Careerbuilder is shown in green and Indeed is in purple.

Lesson learned: the mindshare leaders aren’t necessarily looming large over the rest of the niche. Knowing this helps you keep your guard up against big threats that could have slipped by.

8. Catch the stealth competitors no one thinks of

Most people would seek out competitors that rank for a high number of keywords, but you know something wiser: quantity doesn’t necessarily rule here.

If you keep this in mind, you can do more than just be alert. You can learn from and emulate a competitor that has **focused and valuable SEO. **You gain more ground when you add competitive analysis into your SEO work.

Effective SEO: focused and valuable

Think again of the domain that ranks for more keywords than any other in the niche. Many of those keywords on their long list could easily be irrelevant, throw-away keywords. (Linkedin.com ranks for “ako” and “capital of Spain” to name a few.) If you’re going to look for a domain whose SEO delivers meaningful traffic, skip the keyword count and look at who is ranking on valuable keywords.

Fortunately, that’s an easy task on the chart.

Let’s go back to using the job search industry and use Monster.com again to get its competitors. Remember this doesn’t mean we’re emulating Monster.com. They’re just a way to get started; you could use any domain in the industry.

When we did this in step 1, we used the default metric “SEO Keywords.” This time, click the Monthly Value setting to see the chart tell a very different story.

This view turns all of those clicks into dollars. The value is on par with how much traffic these keywords can deliver. The more competitive the keyword, the more it would command a higher cost per click in AdWords. The same idea holds here in SEO.

Keywords like these pull a lot of weight. They:

- Draw higher costs on the PPC side

- See more activity and searches

- Have a stronger click-through rate (They deliver traffic.)

We consider clicks from these keywords to be more valuable to a domain than other keywords would be. Every organic keyword gets an assigned SEO value. Total up the clicks these sites get from those rankings, and we can trace a domain’s changing SEO value each month.

9. Find the domains that create more value

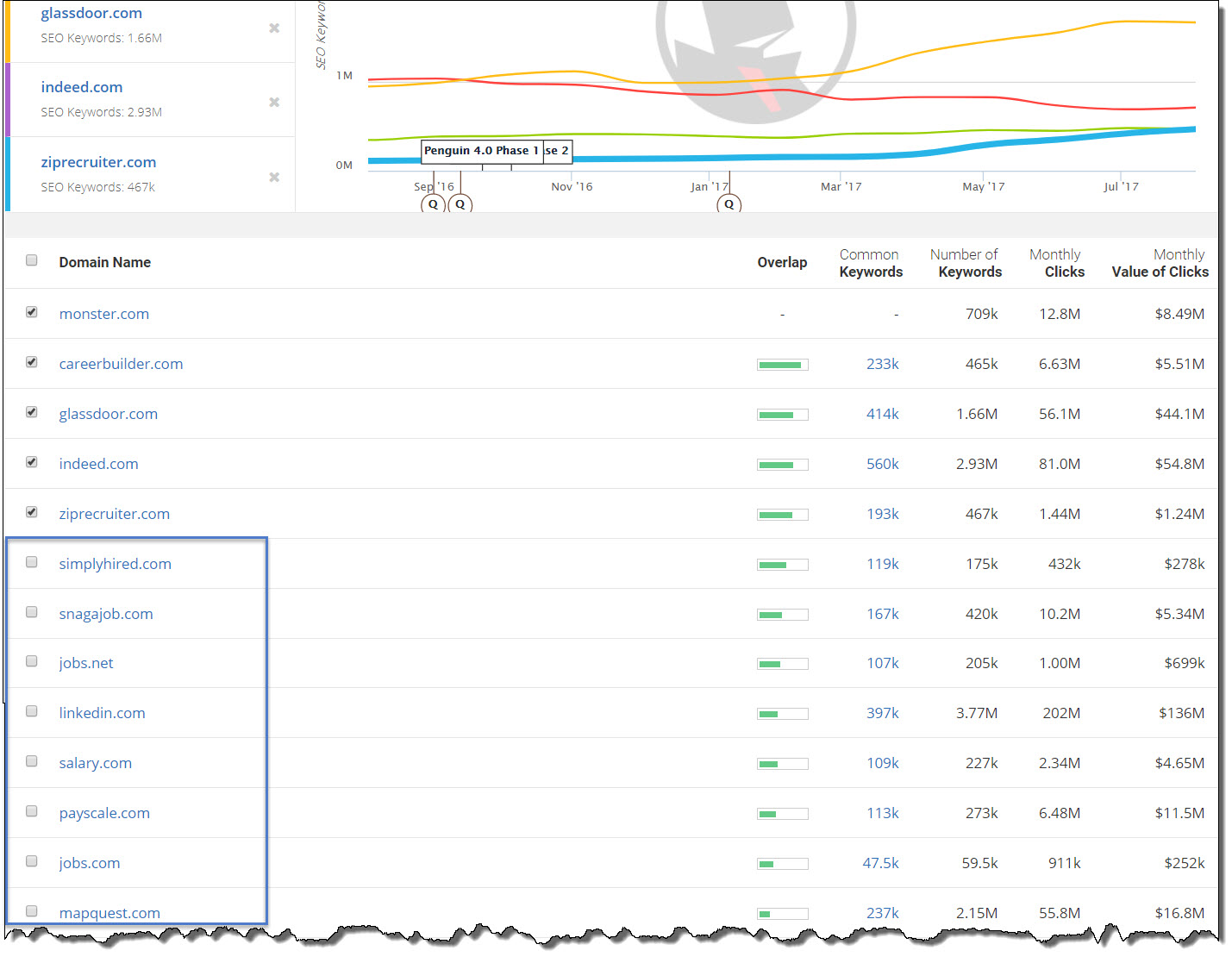

Again, Indeed.com rises above the others. However, there’s more to uncover. We started this hunt to find domains with focused and valuable SEO. Those might be giants (like Indeed.com), but that a domain with a tight focus probably ranks for fewer keywords. If it ranks for fewer keywords, it might be further down the list and tucked away from our view.

Let’s weigh some other stats.

With a monthly SEO value hovering near $55 million each month, Indeed.com creates plenty of value. After Glassdoor.com, the other competitors land closer to $1M to $8 million a month. I kept that target in mind and scrolled down to the full list of Top Organic Competitors. I wanted to see if I could find any other competitors reaching Indeed.com’s levels.

Interesting. With nearly a TENTH of the keywords as Indeed.com, Payscale.com creates $11.5M each month from its rankings. In all fairness, it’s not as close of a competitor to Monster as the others are, but we’re looking for new ideas in the industry. This one suits exactly what we’re hoping to find.

You can add Payscale.com to the chart by clicking the checkbox next to the domain.

Now I can see both Indeed.com and Payscale.com as two strong domains that create more value overall from their organic content. It’s not a race to see who ranks for more keywords. The goal is to capture relevant and valuable traffic, and these domains show a better list of keywords that their content appears on.

You can also drill into each domain to find the content that pulls in the most traffic for them. Remember it's not always the home page that gets them visitors. People might find a competitor because of an evergreen article that dominates multiple keyword SERPs.

Look at this domain in SpyFu's Top Pages section, and it will be easy to spot their content that ranks for multiple keywords and gets the most organic clicks. You will find their top traffic pages (from SERPs), the estimated clicks that they get from those SERPs, and the keywords that those pages rank for.

By analyzing these metrics, you can pinpoint their high-value content and identify the keywords that could be good ones for you to consider.

Now you've learned strong competitors in a space as well as the strongest content they lean on for organic visitors.

10. Just a little more about Clicks vs. Value

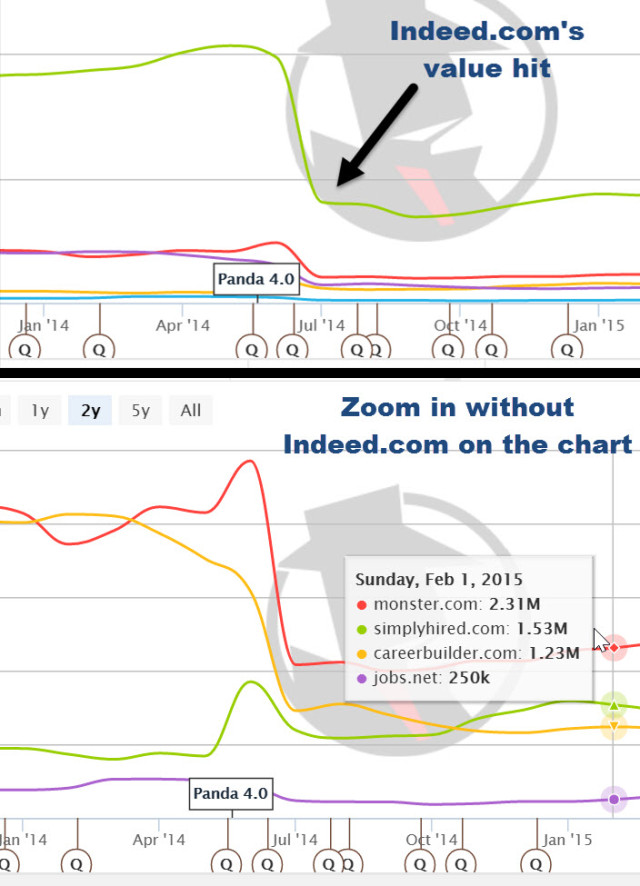

In this particular set of competitors, there’s one shift from clicks to value that is so strong, I wanted to see it side-by-side against the first chart.

Note: The clone functionality has since been removed. The example is left to help demonstrate clicks vs value.

Let’s leave the top chart set to “Monthly Clicks.” It shows the traffic that these domains get from ranking where they do on their keywords. The next chart is our sandbox.

The green line represents Indeed.com in both charts. They’re showing an identical time frame. See how the domain’s clicks hold steady in the top chart while its value (from those clicks) drops?

No doubt that Indeed.com is still an industry powerhouse in SEO. We just see their huge keyword list in a new light. We could guess that they are ranking on irrelevant keywords…maybe? But then they would have to be getting a lot of clicks from them because their monthly clicks didn’t fall the way that value did. Hmm…

It would be fair to say that they consistently get many clicks from their relevant keywords — far more than their competitors do on the same keywords.

Remember, the number of clicks holds steady. This probably means that Indeed.com tends to rank in higher positions across a large portion of their keywords. They’re getting the bigger share of clicks. But then the bottom falls out, and those clicks lose value. Drastically.

It could be that keywords across the industry took a dip in value. Maybe Indeed.com just shows it more dramatically because of how it flattens other domain tracks on the chart.

It’s worth a look. Back to cloning!

Just in case the scale is skewing things, I’m removing Indeed.com from my second cloned chart. It helps me see if the competing domains also took a value hit in July 2014.

Blammo again. It looks like they all fell, and Indeed.com’s big numbers had been masking that. Our suspicions about an industry-wide drop in keyword-value seems to be confirmed. My guess? Certain job trends shifted, or people just stopped searching for a certain category of keywords that they had before.

11. Learn from Competitors and Trends

Keep comparing competitors. Change views, change time periods, and change who’s on the chart. Start from scratch and add your own domain. (Hint: this button helps)

You’re not limited to just SEO competitors. Use the “PPC Competitors” button on top of the chart to jump to another view. You can also navigate there through the PPC Research tab.

In Closing

Remember that said, any marketing strategy, including digital marketing, should start with competitor analysis. An SEO strategy is no exception. But also, it doesn't end as a one-time-task you check off your list. Building it into your ongoing strategy and decisions will help you establish yourself as a more authoritative voice in your space.